The 9% tax credit application process is very competitive. Every point counts. Every dollar counts. That’s why seasoned developers look closely at parameters such as land cost per unit, total development cost per unit, annual tax credit per unit, tax credit equity per unit, and tax credit pricing ($ equity / $ tax credit) when putting together their proposals.

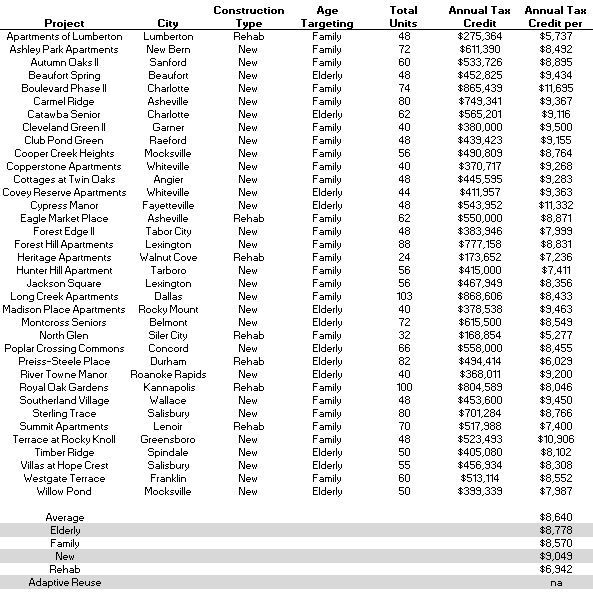

In North Carolina the #1 tiebreaker criteria is tax credit per unit. Projects with the least amount of federal credit per unit are given priority over competing projects, all other things being equal. In the table below we give the annual tax credit per unit for projects awarded credits in 2012.

For the North Carolina projects that received awards in 2012, the average annual tax credit was $8,640 per unit. Age restricted (elderly) projects averaged $8,778 per unit, while general occupancy (family) came in at $8,570. New construction deals averaged $9,049 per unit, while rehabilitation came in at $6,942. There were no adaptive reuse projects in North Carolina’s 2012 allocation.

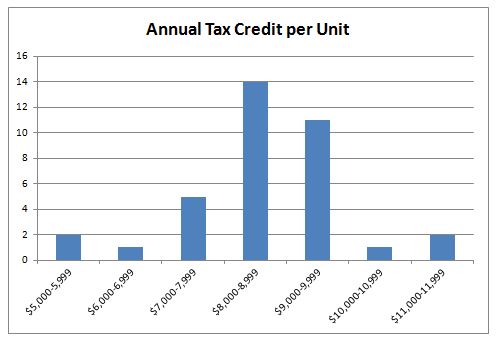

The graph below shows the distribution of awards.

The majority of awarded projects were clustered between $8,000-10,000 per unit. Only a few projects exceeded this amount. In order to be competitive, developers should attempt to keep their projects below $10,000 per unit in annual tax credits.

Allen & Associates Consulting, Inc. specializes in development consulting. Feel free to contact me (Jeff Carroll) at 704-905-2276 with any questions you may have regarding your tax credit development.