State and local governments sell tax-exempt bonds to finance apartments affordable to lower income families. According to the National Council of State Housing Agencies (NCSHA), multifamily housing bonds have been used to produce nearly 1 million affordable apartment units in the United States.

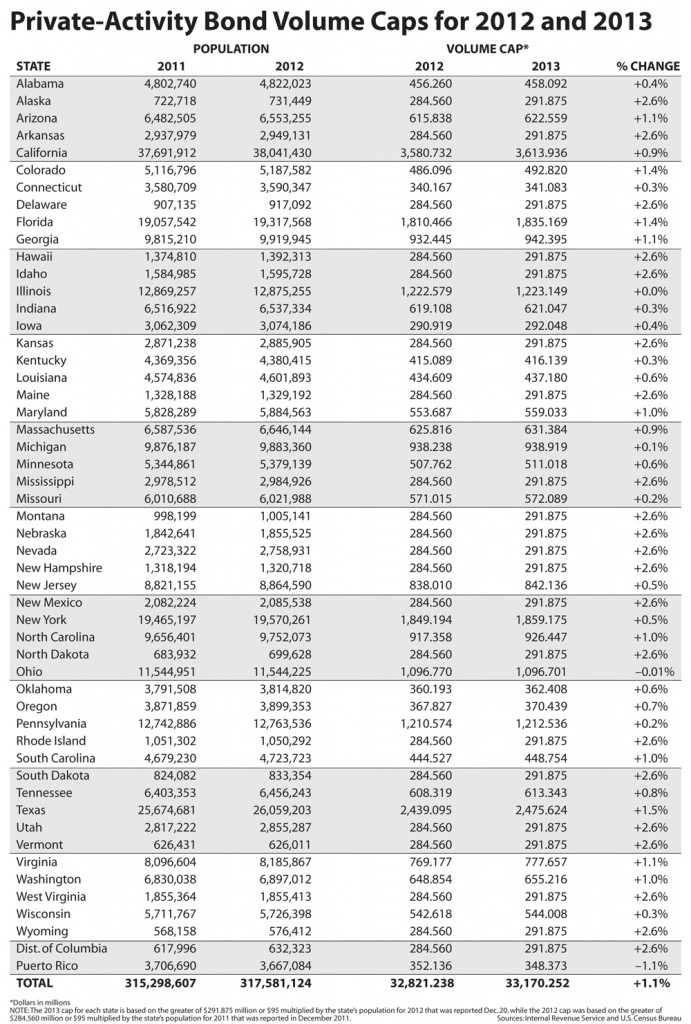

These bonds are “tax-exempt” because the purchasers do not have to pay taxes on interest payments. Consequently, purchasers are generally willing to accept lower interest payments for these bonds because of the tax savings. These bonds are also sometimes referred to as “private activity bonds” because they are used to promote private investment for the benefit of the public (the production of affordable housing). Each state is authorized to issue a set amount of private activity bonds under IRC §142(d)). According to The Bond Buyer, the 2013 volume cap for each state is the greater of $95 per capita or $291,870,000.

When applying for bonds, a sponsor approaches an issuer (typically a city, or a county, or a housing authority) to petition the state to issue a portion of their volume cap of private activity bonds. Each state has different policies regarding how this process works. Virginia, for example, issues bonds through the state housing finance agency (VHDA). North Carolina, on the other hand, has established a policy of looking to local housing authorities to issue bonds (NCHFA). Issuers often prefer that bond transactions benefit from credit enhancement through a recognized provider (HUD, Fannie Mae, Freddie Mac).

Multifamily housing projects that are financed with tax-exempt bonds are also eligible for 4% housing tax credits. Unlike the 9% credit, there is no “limited pool” for the 4% housing tax credit. To obtain 4% credits, a sponsor must apply to the state housing finance agency for the credits. Local bond issuers are not authorized to allocate the 4% tax credit.

Feel free to contact me (Jeff Carroll) at 704-905-2276 with any questions you may have regarding your bond-financed property.