As we pointed out in a previous post, the 2013 North Carolina Housing Finance Agency (NCHFA) Qualified Allocation Plan (QAP) includes a requirement that all 9% tax credit deals include at least one principal who has successfully developed, operated and maintained at least one 9% tax credit project in the state of North Carolina. Such projects must have been placed in service between December 1, 2006 and January 1, 2012.

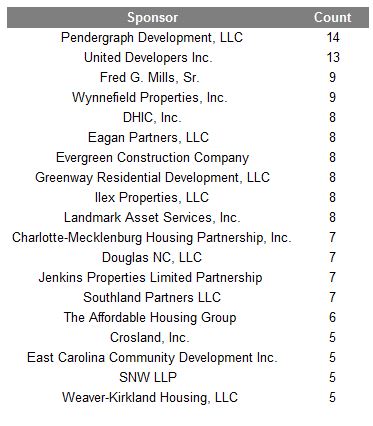

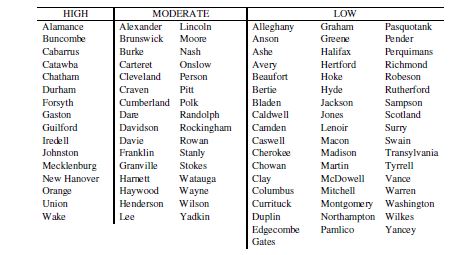

The following table presents the top sponsors of 9% tax credit deals in North Carolina. The table lists the sponsor’s name and the number of tax credit awards between 2006 and 2012:

It is important to note that the sponsors listed may have actually partnered with other entities on these projects.

Allen & Associates has worked with developers on over 300 projects in North Carolina since 2000. Our professional network includes relationships with principals meeting NCHFA’s experienced developer criteria. We can assist in putting together a successful development team for your project.

Feel free to contact me (Jeff Carroll) at 704-905-2276 with any questions you may have regarding your project.