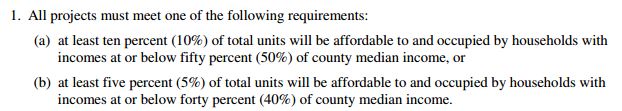

HUD defines “very low income households” as households earning less than 50% of Area Median Income (AMI). Tax-exempt bond deals in North Carolina are required to set aside a portion of their units for these lower-income households:

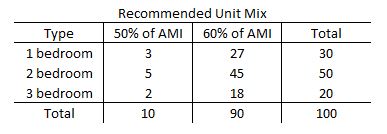

Developers often ask whether it is possible to group these units into the lowest-rent unit type (1-bedroom versus 2- and 3-bedroom units). State housing finance agencies normally prefer to see the lower-income units distributed proportionally between unit types.

Assuming 50% and 60% rent and income targeting for a 100-unit deal consisting of 1-, 2- and 3-bedroom units, the unit mix would look something like this:

Feel free to contact me (Jeff Carroll) at 704-905-2276 with any questions you may have regarding your bond-financed property.