Section 42 of the IRS Code defines a “qualified low-income housing project” as a residential rental project that meets one of the following two tests:

- 20-50 Test. Twenty percent or more of the residential units are both rent-restricted and occupied by individuals whose income is 50 percent or less of area median income (AMI)

- 40-60 Test. Forty percent or more of the residential units are both rent-restricted and occupied by individuals whose income is 60 percent or less of area median gross income (AMI)

The states, however, often provide point-scoring incentives through their Qualified Allocation Plans (QAPs) to achieve even lower rent and income targeting. The North Carolina Housing Finance Agency, for example, has established the following criteria in its QAP:

- If the project is in a High Income county: (a) Five points will be awarded if at least 25% of the units are affordable to and occupied by households with incomes at or below 30% of AMI, or (b) Two points will be awarded if at least 50% of the units are affordable to and occupied by households with incomes at or below 40% of AMI.

- If the project is in a Moderate Income county: (a) Five points will be awarded if at least 25% of the units are affordable to and occupied by households with incomes at or below 40% of AMI, or (b) Two points will be awarded if at least 50% of the units are affordable to and occupied by households with incomes at or below 50% of AMI.

- If the project is in a Low Income county: Five points will be awarded if at least 40% of the units are affordable to and occupied by households with incomes at or below 50% of AMI.

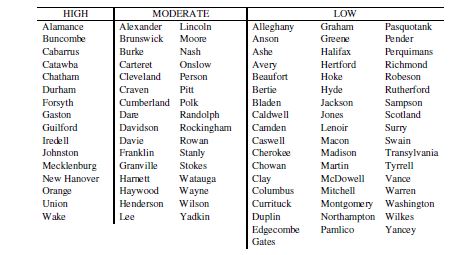

A chart showing which counties are considered high, moderate, or low income is found below:

The application process is very competitive. We regularly see developers opting for the deepest income targets in order to earn the most points for their development proposals.

Feel free to contact me (Jeff Carroll) at 704-905-2276 with any questions you may have regarding your tax credit financed property.