The North Carolina Housing Finance Agency (NCHFA) administers the state tax credit (STC) in conjunction with the North Carolina Department of Revenue (NCDOR). Projects with an award of 9% credits under the federal program are eligible for the STC. The state requires more restrictive income targeting for these projects, however (projects must comply with these limits for 30 years):

- If the project is in a High Income county: (a) 25% of the units must be affordable to households with incomes at or below 30% of Area Median Income (AMI), or (b) 50% of the units must be affordable to households with incomes at or below 40% of AMI.

- If the project is in a Moderate Income county: 50% of the units must be affordable to households with incomes at or below 50% of AMI.

- If the project is in a Low Income county: 40% of the units must be affordable to households with incomes at or below 50% of AMI.

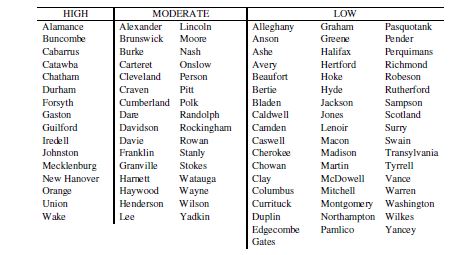

The STC amount is equal to 10%, 20% or 30% of the development’s qualified basis (total development cost less non-depreciable costs and the cost to construct any market rate units). The STC percentage depends on the development’s location. High Income counties can claim a 10% STC; Moderate Income counties can claim 20%; Low Income counties can claim 30%. A chart showing which counties are considered high, moderate, or low income is found below:

Feel free to contact me (Jeff Carroll) at 704-905-2276 with any questions you may have regarding your tax credit financed property.